The Avy Manifesto

We don’t need more infrastructure. We need better distribution. Here's why we’re building the product layer on top of Hyperliquid.

Liquidity is permissionless. Attention is not.

Hyperliquid is fast. Transparent. Unstoppable. Has settled over $1.5 trillion.

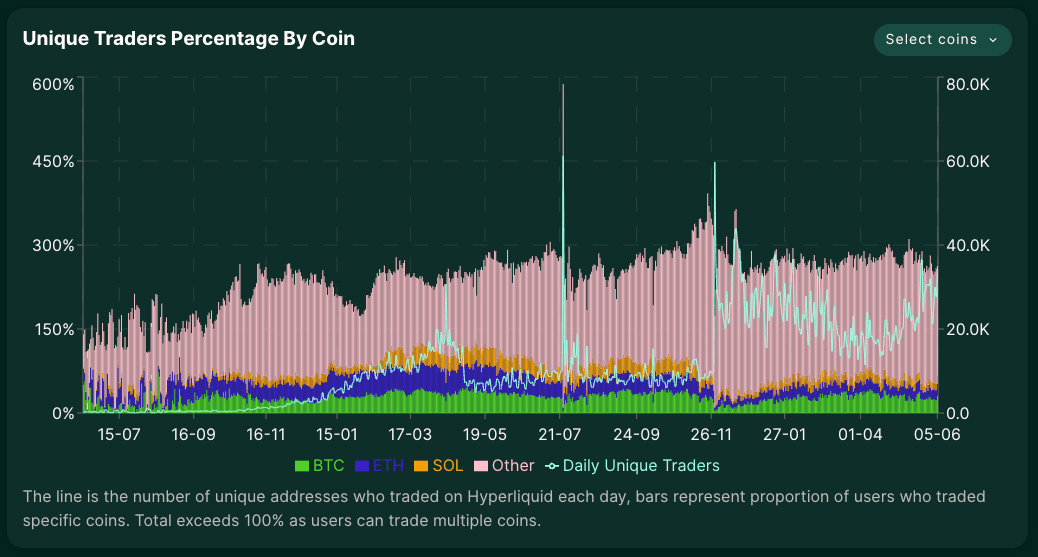

But here’s the thing: the number of daily active traders isn’t growing. And in a space this competitive, flat growth is just a slow decline in disguise.

Despite the performance and polish, Hyperliquid has a huge problem: it struggles to attract new users at scale. The infra is here. The product is ready. The chain is clean.

The distribution isn’t.

What Crypto Doesn’t Need

More protocols. More dev tools. More whitepapers. We’ve got plenty. What we don’t have? Apps that actually onboard people.

Remember TradFi? Robinhood wasn’t building a stock exchange — they built the frontend. The actual execution often happens behind the scenes via partners like Coastal Community Bank. Same with Revolut — their slick user experience ran on top of Solarisbank for years.

What mattered wasn’t the backend. It was the app. The feeling of control. The simplicity.

Hyperliquid is the infrastructure. Avy is the interface.

Hyperliquid is Nasdaq. Avy is the Robinhood.

We’re not building a new chain. Not a new DEX. Not another dashboard. We’re building the interface. The one that finally brings crypto trading to the people who don’t care about RPC endpoints or gas fees.

Swipe. Trade. Done.

Avy is mobile-native. Built for speed. Built for instincts. Built for the dopamine loop.

No KYC. No email. No seed phrase pain.

Just:

- Scan a QR

- Swipe up

- Trade locked in

You’re on Twitter. You see a meme coin pop off. You tap. You’re long. Meanwhile, someone else is still fumbling with MetaMask.

That’s the difference.

$38B FDV. 30k Traders. Something Doesn’t Add Up.

HYPE trades at $38. With a total supply of 1 billion tokens, that puts Hyperliquid’s fully diluted valuation at $38 billion. But here’s the disconnect: daily active traders are stuck at ~30,000. That’s over $1.2 million in FDV per user.

That’s a bet — a big one — that Hyperliquid becomes the trading backend for everything. We think it’s half-right. Yes, Hyperliquid is the engine. But you still need someone to build the car. You still need a steering wheel. You still need users.

That’s where Avy steps in. We take HYPE’s potential and make it real. By giving people a place to actually trade — fast, fun, mobile — we grow Hyperliquid’s surface area. That’s what this is: user growth as protocol leverage.

HIP-3 Was the Unlock

Then came HIP-3.

Hyperliquid made liquidity programmable. Anyone with 1M HYPE can list perp markets. Just like that.

Which means…

Whoever owns the frontend can own the flow.

Own the narrative.

Own the upside.

We don’t just list tokens.

We launch markets.

That’s powerful. But it gets better.

We Are Bullish on User-Deployed Markets

We’re not just bullish. We’re degen long.

User-deployed markets change everything. For the first time, the creation of trading venues is no longer a bureaucratic process — it's permissionless. That opens up a massive design space.

We’re bullish because whoever owns distribution — whoever controls the frontend — gets to steer the flow of attention, liquidity, and fees into the markets they showcase. This is a power shift. From centralized gatekeepers to product-driven platforms.

If Hyperliquid becomes the backend of trading, then user-deployed markets are the way to differentiate and build economic gravity. They let us escape the race-to-the-bottom game of liquidity aggregation and instead win by curation, UX, and timing.

In that world, the frontend isn’t just a UI. It’s a market maker.

That’s the bet. That’s the upside. That’s why we’re here.

The Experience Layer Is the Moat

Protocols can be forked. Liquidity can move. But user habits? That’s sticky.

If you control the experience layer, you control:

- What gets traded

- Where it gets traded

- How it gets discovered

- And who gets paid

Owning the app is like owning the App Store. It’s not UI polish. It’s market control.

We Believe...

- The next 100x won’t come from infra. It’ll come from UX.

- Meme traders are TikTok users with wallets. Give them swipes.

- Wallets should be invisible.

- Trading should feel like Tinder. Not Excel.

- UX wins markets. Period.

We’re not building a wallet. We’re not building a DEX.

We’re building the front door.

Use Cases: What This Enables

→ Community-Created Markets

Hold HYPE? Spin up a perp. We’ll give it a home.

→ Mobile-Native Pro Trading

Get a price alert. React in seconds. No laptop required.

→ Invisible Onboarding

New to crypto? Doesn’t matter. Feels like Robinhood. Powered by Hyperliquid.

The Road Ahead

Here’s where we’re going next:

- Design iteration — gesture-first, haptics, realtime feedback

- Frictionless onboarding — wallets fade away, fiat ramps fade in

- New market listings — We are the frontend that lists markets HL won't list

- Innovative features — AI Market Reccomendation, Stealth mode, Sleep mode

We’ll obsess over every pixel. Because every second matters.

If you believe crypto UX is broken — and that the interface is the next billion-dollar unlock —

then you believe what we believe.

Let’s build it.